Merchant Cash Advance Costs

Learn about the actual cost of MCAs and get the funding you need to grow your business.

Last Updated on August 15, 2024

Shield Funding TeamFor small business owners in need of a quick cash infusion, few lending products beat a merchant cash advance, or MCA. With few qualification requirements, MCA underwriting is quick and you can receive the funds in a few days or sometimes as fast as the same day. A merchant cash advance is not a loan and does not have an interest rate. Instead, lenders use a factor rate to determine the cost of the advance and it is added as a fee.

This quick and easy lending product does have some significant drawbacks – chief amongst them is their cost. Merchant cash advances sometimes have annual percentage rates in the triple digits, especially if the terms are significantly less than a year. Comparing one product to another can also be misleading, especially if you apply the math of traditional financing APRs to revenue based financing. MCAs are not right for everybody but they can be a lifesaver for the companies that require MCAs and use them wisely. Here’s what you need to know about the true costs of merchant cash advances.

Work with a Direct Lender and get a merchant cash advance as fast as the same day. Shield Funding offers competitive rates and terms on all it’s funding programs. We have been assisting business owners for two decades.

Lenders charge a flat fee for a merchant cash advance. They use the factor rate – expressed as 1.1 to 1.5 (translated to 10%-50%) – to calculate this fee. This is the typical range for most MCA loans available today.

To calculate the cost of an MCA, you multiply the amount of the advance by the factor rate. For example, if you receive a $50,000 advance with a factor rate of 1.3, you would payback $65,000 ($50,000 x 1.3). This calculation gives you the total repayment amount which includes the advance and the fee for taking the advance. The fee can be viewed as an interest rate because it is calculated as 30%, but it is not a loan and doesn’t provide an annual percentage rate (APR) as some other financial products do.

If you have previously used business credit cards or traditional bank loans to meet your small business’ capital needs, you’re familiar with the annual percentage rate, or APR. This rate is a standard formula created for the purpose of comparing some financial products. However, MCA’s should be viewed differently because they are not credit cards or bank loans. MCAs have a fee on top of the borrowed amount, and as long as that fee makes sense for your endeavor it is pretty straightforward.

The factor rate is determined by several factors, including your business’s monthly credit card sales or overall revenue deposits, the length of time your business has been operating, the industry you’re in, and your personal credit history. Also considered is the direction of revenue on a month by month basis, as well as the overall management of the business bank account, such as daily balances and bounced payments.

Businesses with consistent strong sales, a long operating history, a stable industry, good bank account management, and good paying credit profile are likely to receive a lower factor rate and higher approval amounts.

Comparing the rate on a merchant cash advance to other financial products can be quite tricky. The compounding interest can make the calculations a bit complex because you may have a daily payment with an MCA whereas bank loans and credit cards often have one monthly payment or just 12 a year. However, many people rely on the benchmark of APR just for comparing so we will provide the math for both annualized interest and APR.

To understand the true cost of an MCA, it’s helpful to convert the factor rate to an APR. This conversion can be complex because MCAs don’t have a set repayment term. The APR will vary depending on how quickly you repay the advance. The faster you repay, the higher the APR.

The true APR of an MCA includes not only the factor rate but also any additional fees charged by the provider. These fees can include origination fees, processing fees, and other costs. To calculate the true APR, you need to add up all the costs of the advance, including the total repayment amount and any additional fees, and then do the math. For disclosure purposes it is important to keep in mind that there are several ways to do this calculation, and they all have different answers. This is just one way to calculate true APR on an MCA.

Let’s consider a real-world scenario where a business obtains a Merchant Cash Advance of $100,000 with a factor rate of 1.3 for a period of 12 months. The origination fee is $1,000, and the processing fees amount to $250. There are no other fees involved. Payments are made five days a week.

Step 1: Calculate the Total Repayment Amount

First, we need to calculate the total repayment amount. This is done by multiplying the amount of the MCA by the factor rate:

$100,000 (MCA amount) x 1.3 (factor rate) = $130,000

Step 2: Calculate the Total Cost of the MCA

Next, we add the origination fee and the processing fees to the total repayment amount:

$130,000 (total repayment amount) + $1,000 (origination fee) + $250 (processing fees) = $131,250

This is the total amount that the business will need to repay over the course of 12 months.

Step 3: Calculate the Daily Payment Amount

The daily payment amount is calculated by dividing the total cost of the MCA by the total number of payment days in a year. Since payments are made five days a week, there are 260 payment days in a year (52 weeks x 5 days):

$131,250 (total cost of MCA) ÷ 260 (payment days) = $504.81

This is the amount that the business will need to repay each day of the Monday to Friday payment period.

Step 4: Calculate the True APR

To calculate the APR (Annual Percentage Rate) for a Merchant Cash Advance, we need to understand the concept of APR first. APR is a measure of the cost of credit expressed as a yearly interest rate. It includes the interest rate and other costs or fees (like origination fees or closing costs) involved in obtaining the credit.

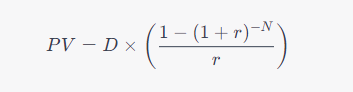

Calculating APR for a loan with fixed payments is straightforward, but calculating the APR for a product like an MCA, where the balance decreases with each daily payment, requires a more complex calculation. Essentially, we need to solve for the interest rate in the formula for an amortizing loan and we get a very close approximation.

To find the APR, we need to first determine the daily interest rate.

Since we know the daily payment amount ($504.81), the present value or initial loan amount ($100,000), and the number of payment periods (260 days), and the total payback amount ($131,250) we can plug these values into the present value formula and solve for (r). The daily interest rate in this example is approximately 0.219%. This is the rate at which interest effectively accrues on the remaining balance of the loan on a daily basis. Remember, while this may seem small on a daily basis, it compounds rapidly due to daily payments, leading to the much higher APR we calculated earlier.

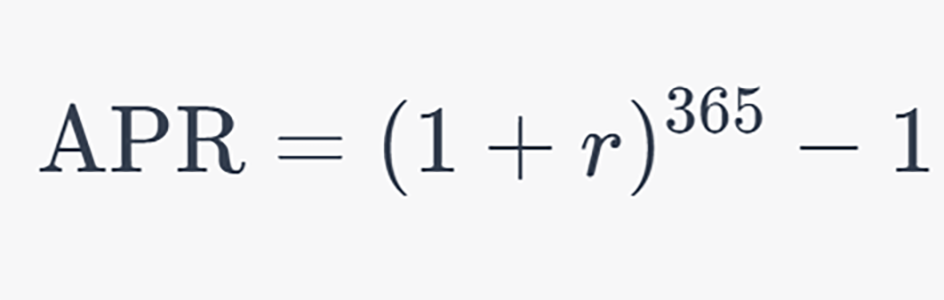

Finally, to convert the daily rate (r) to an annual rate (APR), we’ll use the formula:

Finally, to convert the daily rate (r) to an annual rate (APR), we’ll use the formula:

The true Annual Percentage Rate (APR) for the Merchant Cash Advance in this case study is approximately 122.15%. This means that if the MCA were treated as a loan (for tax purposes it is not), the interest rate on that loan would be around 122% per year. Please note that this is a simplified calculation and actual terms may vary. Additionally, you could use other calculations such as calculating average daily balances and get closer to 80%. The formula here was mainly to demonstrate the difference between interest and APR on a merchant cash advance.

This case study illustrates that the true cost of an MCA can be significantly higher than traditional forms of financing. It also shows that your given factor rate or interest rate in an MCA is going to be much less than your true APR if you are making daily payments. It’s crucial for businesses to understand these costs and to consider all financing options before deciding on an MCA.

Another common way the costs of MCAs are viewed are with interest rates. The interest rate is the lens with which most people view financial products when they are not considering APR. So in the example above, $100,000 and paying back $131,250 in a 12 month period makes the annualized interest rate 31.25%. With MCAs, the factor rate with a contract for a year is the annualized interest. Where determining the annualized interest rate gets a little more complicated, is when the contract is less than a year.

In the same example above, if you pay that same amount in 6 months you have effectively doubled your annualized interest rate to approximately 62%. You can see how it is easy to double, triple and quadruple annual interest rates based on a particular time period.

The math on the above deal works like this on a 6 month contract:

1. Repayment Amount = Advance Amount x Factor Rate: $100,000 x 1.30 = $130,000

2. Cost Percentage = Divide your fee by the loan amount: $30,000/$100,000 = .30 or 30% ( to keep simple we left out the $1,250 in fees which would be .3125 or 31.25 %)

3. Annual Rate = Cost percentage divided by days in a year: 0.30 x 365 = 109.5

4. Annual Interest Rate = Annual rate divided by actual days of offer: 109.5/180 = 0.6083 or 60.83%

All of these mathematical examples are meant to highlight the different rates you will read and how they can help you compare financial products. Interest rates are not the only fees with MCAs.

Each MCA provider could charge different fees. There is a wide variety within the industry, with most providers charging only two of these fees. However, some lenders could charge you every fee on this list.

Application fee – fee payable when you apply for the MCA.

Underwriting fee – this fee covers the costs of underwriting, which is when the lender verifies your qualifications for the MCA.

Administrative fee – charged to set up your account.

Bank fee – can be there as the processing fee for setting up the transaction.

Broker fee – a fee paid to any intermediary who brought your MCA application to the provider.

Risk fee – similar to the underwriting fee, this fee covers the time and effort the provider puts into evaluating your risk profile.

Loan fee or origination fee – this fee is a percentage of the total advance, and is charged to originate the loan.

Providers deduct these fees from the original advance. If you applied for an advance of $10,000 and the provider charges $2,000 in fees, you’ll only receive $8,000.

Since an MCA can be so expensive, you’re probably wondering how the MCA is repaid. Providers take their repayment in one of three ways:

Split withholding – your credit card processor splits credit card sales between your merchant account and the provider, sending their percentage directly to the provider.

ACH Withdrawal – the provider automatically deducts repayment from your business checking account.

Lockbox or Bank Withholding – your bank splits your credit card sales between your bank account and the MCA provider

Payments could be taken daily, most common with the first 2 repayment methods, or weekly which is reserved for more stable borrower profiles. Because merchant cash advance providers charge a flat fee, for most lenders there is no benefit to you for prepayment. Unlike paying off a traditional, amortizing loan early, you’ll realize no savings on interest.

The disadvantage to picking the ACH withdrawal repayment method is that you have to make sure the funds for the payment are in your business checking account, otherwise the payment could bounce. The lockbox method delays the release of credit card sales by a day, which could lead to further cash flow issues. Whatever repayment method your MCA provider chooses, put it in your budget and plan for it.

But to plan for a payment, you need to know how much money to set aside.

MCA providers take their repayment via a holdback percentage. This percentage is the percent of sales that will be “held back” and remitted to the provider. Don’t confuse it with the interest rate paid on a loan – it’s only the percent of sales taken for repayment.

MCA providers commonly charge holdbacks of 10% to 20%. If you have daily credit card sales of $10,000 and a holdback of 15%, the MCA provider would be entitled to $1,500 of those sales as repayment towards paying back the advance.

For some small business owners, this method of repayment is easier than writing a large, monthly check to a bank. With split withholding, you don’t have to worry about forgetting to mail a check or deposit funds into a checking account.

What if you chose ACH withholding for repayment? A similar concept applies – they’re entitled to the holdback percentage of daily sales. However, it’s your responsibility to ensure that the $1,500 is in your business checking account the day payment is due.

Repaying an MCA with a percentage of sales has the advantage of aligning sales with repayments. During a slow week, you pay less towards your merchant cash advance. This can really help with cash flow. However, the disadvantage is that if sales dip, it’ll take longer to pay off the advance, although some may see this as an advantage. The point is to be aware of how it works and plan accordingly.

Before taking an MCA, it’s crucial to understand the true cost and to consider other financing options. MCAs can be a useful tool for businesses that need quick access to cash and have a high volume of credit card sales. However, the high cost can put significant pressure on your cash flow and make it harder to operate your business.

A MCA is a financial tool, and to use it successfully you should take the time to fully grasp how it will impact your cash flows.

Continuing with the same example above, you owe the MCA lender $225,000, repaid through withdrawals over an average of 22 working days a month. Sales average $30,000 a week and your holdback is 18%.

Weekly, you’ll pay the provider $5,400, monthly approx. $21,600. At this pace, it will take just over ten months to pay off the advance. But that’s assuming your business doesn’t have seasonal dips and sales remain stable.

What’s more, if working capital expenses are $22,000 a week and you’re paying an MCA provider $5,400, your free cash flow is only $2,600. If you’re not careful, money could get very tight. A 15% rent increase, a citywide mandate to raise the minimum wage, and you’re operating in the red.

Before taking out a MCA, crunch these numbers and run a few different scenarios to prepare estimated budgets. Try creating a budget based on a 5-10% dip or a 5-10% growth in sales, or one that factors in how an increase in supplies would impact costs, whatever applies best to your business. Before you sign the MCA’s paperwork, take the time to gain a full understanding of its potential impact on your business.

When comparing different financing options, consider the total cost, the repayment terms, and the impact on your cash flow. Look for options with lower interest rates and APRs and more flexible repayment terms. Also, consider non-debt options, such as trade credit.

Understanding the true cost of an MCA is crucial for making an informed decision. Use online calculators to estimate the APR and compare it with other financing options. Also, consider seeking advice from a financial advisor or a business mentor.

While MCAs can provide quick access to cash, they come with high costs and can put pressure on your cash flow. Before taking an MCA, make sure you understand the true cost and have considered all other options. And remember, the best way to avoid needing an MCA is to manage your cash flow effectively and plan for future financing needs.

Work with a Direct Lender and get a merchant cash advance as fast as the same day. Shield Funding offers competitive rates and terms on all it’s funding programs. We have been assisting business owners for two decades.