Last Updated on January 25, 2015

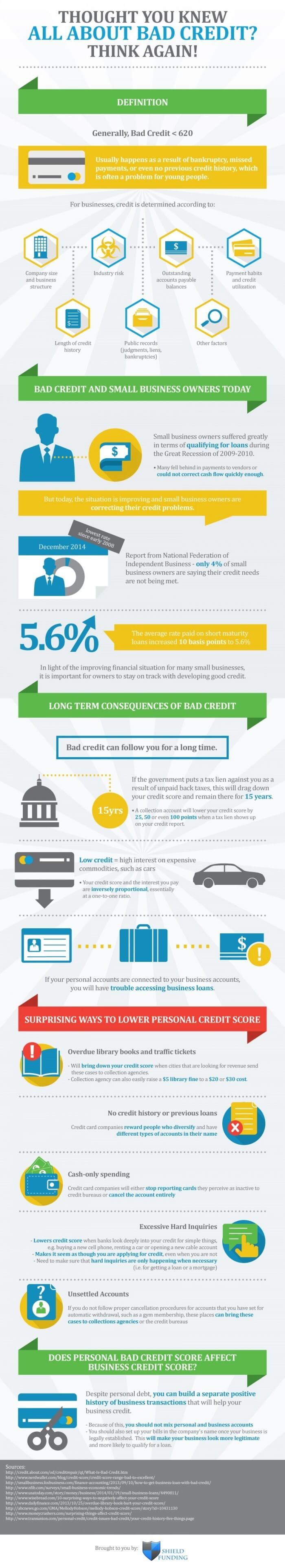

When you are a small business owner, you often hear the term “bad credit” and are warned to avoid this phenomenon like the plague. Fortunately for those who cannot avoid it, there are companies like Shield Funding that offer small business loans bad credit without impressive tax returns or lengthy credit checks. Regardless, the questions about bad credit still stand: Why has bad credit for small businesses become so prevalent in recent years? What percentage of small business owners are still dealing with bad credit today? What are simple things that you can do to improve your personal credit score, and how should your personal and business accounts interact? With this infographic, we hope to answer these questions and more, while also giving you the tools you need to start or develop your small business.