In 2008 the small business lending industry progressively tightened for several years and finding a lender willing to provide a small business loan was next to impossible. However, because the economy has turned there has been a significant shift in the business credit markets. Now business funding opportunities are much more available for small business owners. It is not just that there has been a positive trend in macroeconomic factors resulting in a slightly more flexible bank lending process; it has been the growth in alternative lenders and the many internet platforms that facilitate easy access to additional funding.

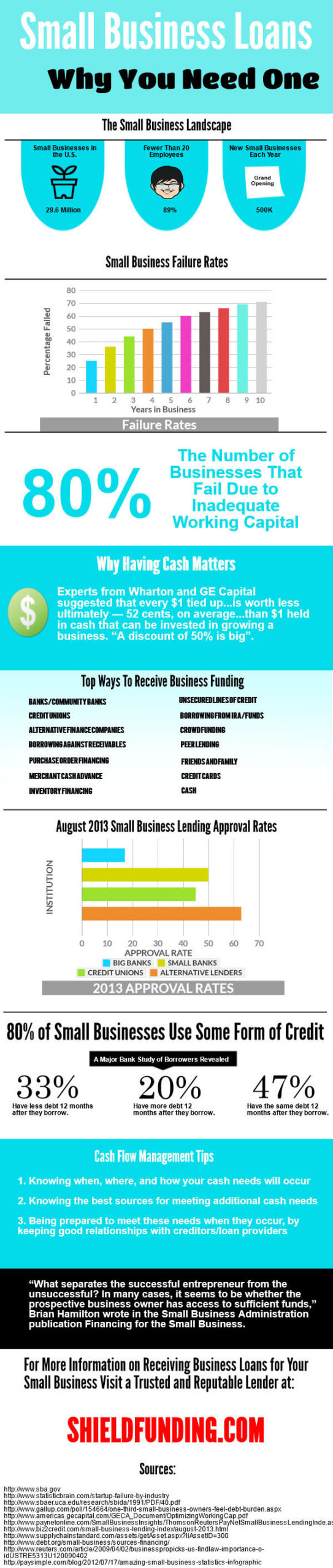

Now that money is available, many small business owners are still unsure of whether or not to take on a business loan. The information below compiled by Shield Funding experts highlights factual data to demonstrate how it is in the best interest of small business owners to seek out and acquire additional financing. We are a trusted and reliable lender that offers small business loans and merchant cash advances at competitive rates for small business owners that do not meet the current standards for traditional lending.